Blog

- Details

- Hits: 40

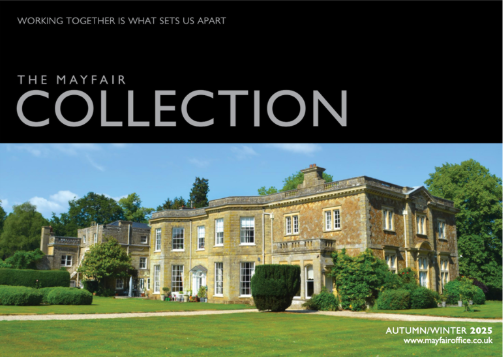

The digital Autumn/Winter 2025 issue of Mayfair Collection is now available by clicking here

- Details

- Hits: 2368

Stamp Duty changes 2025

On April 1, 2025, most Stamp Duty Land Tax (SDLT) thresholds will drop, meaning you could go from paying zero SDLT to paying several thousand pounds or more.

Stamp Duty Land Tax (SDLT) Changes Effective April 1, 2025

Stamp Duty payments differ based on factors such as residency status and buying purpose. So, for example, a first-time buyer will pay SDLT at a different rate to someone purchasing a second property.

Here’s a summary of the changes effective on April 1, 2025:

- Zero rate thresholds for main residences will drop from £250,000 to £125,000, with first-time homebuyer thresholds dropping from £425,000 to £300,000.

- First-Time Buyers Relief (lower stamp duty rate) will drop from £625,000 to £500,000.

- Those buying additional properties will pay 7% stamp duty for property values from £125,001 to £250,000, up from 5%.

Here are the details of these changes:

For Main Residences

In England, stamp duty rates for main residences will be as follows (based on freehold properties):

|

Property Selling Price |

Current SDLT Rate |

SDLT Rate on April 1, 2025 |

|

Up to £125,000 |

0% |

0% |

|

£125,001 to £250,000 |

0% |

2% |

|

£250,001 to £925,000 |

5% |

5% |

|

£925,001 to £1.5 million |

10% |

10% |

|

More than £1.5 million |

12% |

12% |

For First-Time Buyers

Stamp duty changes on April 1, 2025, will have a drastic effect on first-time homebuyers, making homeownership more unaffordable. Stamp duty rates for first-time buyers in England will be as follows:

|

Property Selling Price |

Current SDLT Rate |

SDLT Rate on April 1, 2025 |

|

Up to £300,000 |

0% |

0% |

|

£300,001 to £425,000 |

0% |

5% |

|

£425,001 to £500,000 |

5% |

5% |

|

£500,001 to £625,000 |

5% |

5% |

The First-Time Buyer’s Relief will change from £625,000 to £500,000 – so if you are a first-time buyer paying more than £500,000 for the property, then you are not entitled to the First-time Buyer rates and instead will pay the Standard Rate for Main Residences (as noted above).

If you’re buying a £400,000 property as a first-time buyer, you’re exempt from paying stamp duties until March 31, 2025. From April 1, 2025, you’ll pay £5,000 in stamp duties.

For Additional Home Purchases

If you buy an additional property in England (e.g. a second home or a buy to let), the following thresholds apply:

|

Property Selling Price |

Current SDLT Rate |

SDLT Rate on April 1, 2025 |

|

Up to £125,000 |

5% |

5% |

|

£125,001 to £250,000 |

5% |

7% |

|

£250,001 to £925,000 |

10% |

10% |

|

£925,001 to £1.5 million |

15% |

15% |

|

More than £1.5 million |

17% |

17% |

To get a better idea of your payments, use a Stamp Duty Land Tax Calculator

- Details

- Hits: 3897

Nick Churton of the Mayfair Office finds that finding a great property is a bit like finding a great date.

Like dating, finding the perfect property involves exploring different options until you find the one that suits you best. Sometimes one has to kiss lots of frogs until the right one turns up. Occasionally though it can be love at first sight.

Viewing a property has many parallels with going on a first date. Whether it’s a date or a home, it’s essential to have a clear idea of each option. A recent survey found that 45% of respondents reported that the top place to find a date was online, and an impossible-to-ignore 93% of UK homebuyers use online channels for their property searches. The similarities don't stop there: most people put looks and personality at the top of their most important factors when choosing a date or viewing a property.

But appearances can be deceptive. Talented photographers can flatter their subjects. People and properties in the raw can often disappoint. What’s needed is not a just-got-up-from-a-bad-night’s-sleep photo but a going-to-the-ball image. And as you can’t always rely on a photo, an in-the-flesh meeting is essential to decide whether you can go through life with a particular person or property.

One UK property portal is the 12th most popular website overall in Great Britain and is number 176 across the world. With statistics like those it’s clear that showing your property at its very best online is crucial, especially as looks and personality are key decision-making factors. Put simply, for a date or for a home you have to get people swiping right and not left.

Our website, designed with your convenience in mind, makes it easy for suitors to browse a wide range of attractive possibilities for the ideal match. And that means not having to kiss so many frogs.

- Details

- Hits: 4393

Nick Churton from our Mayfair Office looks forward to a resurgent property market in the New Year.

When a building goes up in flames, the media reports a fire: what it doesn’t do is report the smoke beforehand. Similarly, no one at the moment is headlining the marked increase in property activity witnessed by estate agents in the lead-up to Christmas. In fact, far from a seasonal slowdown, there were more viewings in each month of November and December than in September. There is no smoke without fire, and with this pickup in activity, declining inflation and the likelihood of some falling mortgage interest rates through 2024, we can look forward to an improving property market in the coming months. No doubt also, both Conservative and Labour parties will try to lure the electorate with new housing policies designed to stimulate the property market further.

Nor is this optimism based solely on the above. 2024 saw increased interest from first-time buyers. This trend should continue as we emerge into a more buoyant market that also stimulates second movers, thus making more first-time buyer properties available. This would be the long-wished-for virtuous circle.

Most baby boomers and millennials consider property as part-home and part-investment vehicle. For them property has been the gift that has kept on giving. But let’s look at the property market from the eyes of twenty-year-olds. For them the last decade has been challenging. This group, often priced out of home ownership and suffering increasingly high rents, says they aren’t looking for investment opportunities they’re simply looking for somewhere to lay their heads. Out of the mouths of babes, Generation Z reminds us that first and foremost a home is to live in.

Nor should we forget the role the older generation is playing in this residential resurgence. Baby Boomers might not be moving much themselves at the moment but in 2023 the Bank of Mum and Dad and the Bank of Grandma and Grandpa invested over £8 billion in property: that’s not personal investment but an investment in the futures of their children and grandchildren.

2024 should be a year of looking forward and growing opportunity. Above all it should be a time when property is purchased, but mostly to live in than to trade in. Now that should give the media a blazingly good headline.